Become a successful crypto investor using

The Fundamental Analysis Guide

Learn all crypto investing aspects in one place

for only $9

How to get started investing in cryptocurrencies?

While the crypto market has made many investors rich beyond their wildest dreams, it has also left many others struggling to recover from devastating losses. Remember, this is a high-risk investment with potentially high rewards. Preparation is the key to winning in this game.

Today, the crypto space is bursting with thousands of coins that promise to change the world and deliver incredible profits. But with so many options, it's easy to feel overwhelmed. This space is too complex for most investors. Some people don’t understand it, while others are true believers. Many lose this game because they don’t know how to unlock the hidden potential of crypto investing and avoid common mistakes.

Cryptocurrencies are not a magic wand that can solve our financial problems. They won't replace traditional assets such as stocks, bonds or gold. However, cryptocurrencies can help us achieve our financial goals if we define them and have a strategy to achieve them.

Many people still see investing as a risky and even mysterious endeavor, especially when it comes to cryptocurrencies. But, for many of them, this is just gambling. While luck is necessary to be successful, it is insufficient to stay longer in this game. There is also a common belief that there is a universal strategy that will affect your returns. You will succeed if you discover it. But investing is both easy and difficult.

Many of our choices can be evaluated after a few years, which is why sticking to your strategy or following investment principles can be challenging. In this book, I aim to dispel the misconceptions about crypto investing and show you how to make smart, informed decisions to achieve your financial goals.

Why another book about cryptocurrency investment?

I wanted to write a different book about crypto investing, one that stands out from the rest.

Most publications either:

- focus on the technical side of blockchain and are not for the investors,

- recommend specific coins without explaining why these and not others or

- only use technical analysis or wish thinking.

Even though many books have “fundamental” in the title, they lack a holistic approach to investing. Also, many of them are biased because they don’t consider other financial assets like stocks. This approach is too risky for most investors, especially those just starting out, who are the main target of these publications.

This is the book I wish I had read when I started my journey. Since today, I have not been aware of any comprehensive guide I could recommend to a friend who wants to start investing in crypto.

Who Should Read this Book?

In this book, I start with the fundamental question, “Who should invest and why?”I then discuss different investment practices and show how Crypto can help you achieve your financial goals.

This publication is for people who want to:

- Invest in crypto using an evidence-based approach

- Use knowledge and experience from traditional finance

- Learn all investment aspects in one place

- Broaden their horizons by learning new things at the intersection of crypto and other fields

Who Should NOT Read this Book?

But wait, is this book right for you? With so many crypto-related books and social media content, knowing whom this guide is NOT intended for is important.

This publication is not for people who want to:

- Get recommended trades that may be outdated shortly after publication

- Read stories about projects that can make them rich

- Understand the technical details of various blockchains

- Read about the current market situation

What is the book's structure?

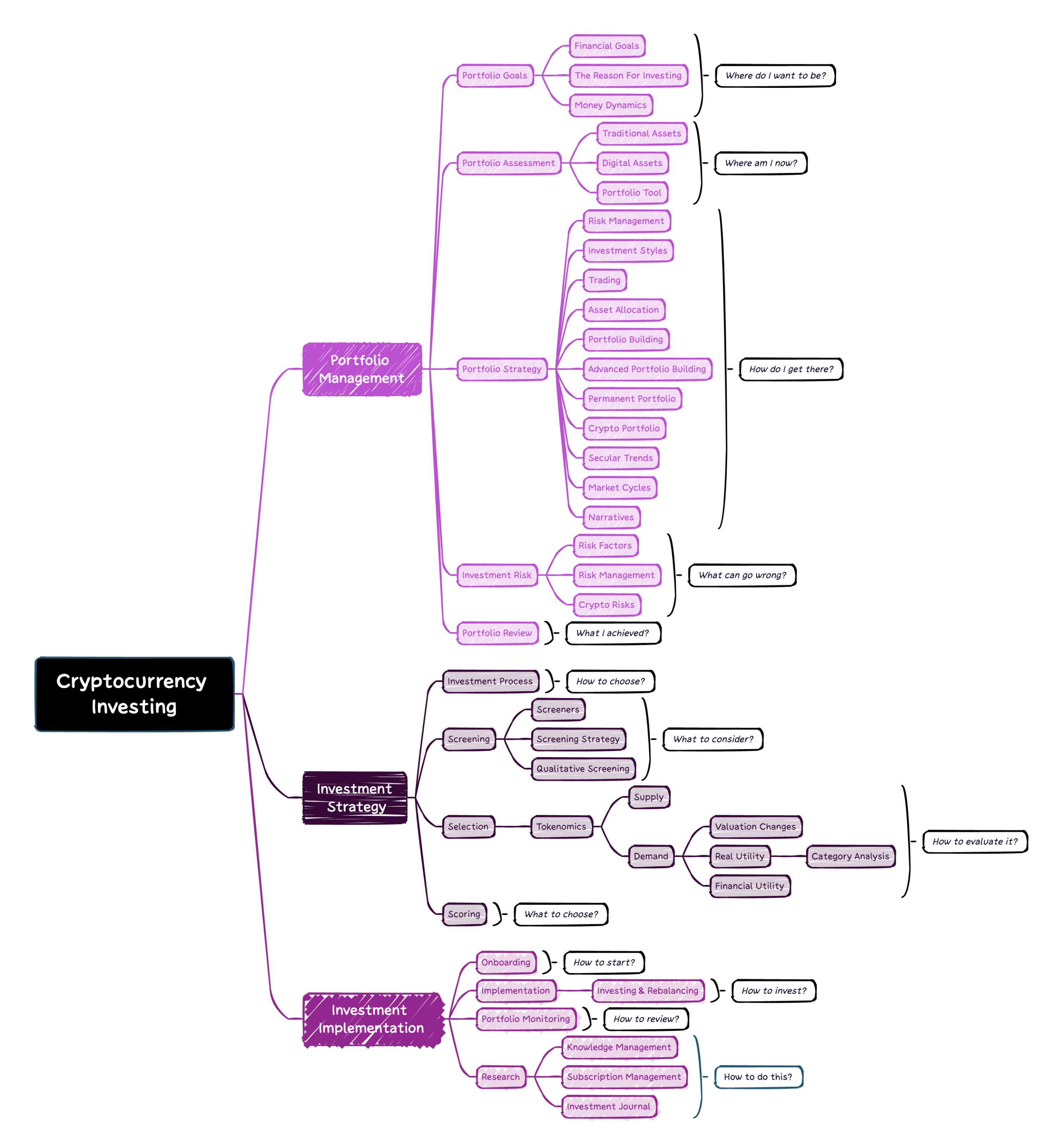

Portfolio Management gives you a holistic view of all investment aspects.

- What are your financial goals?

- What is your financial situation?

- How can you achieve these goals?

- How can you manage the risk?

- How can you evaluate your progress?

Investment Strategy shows you how to build a plan to achieve it.

- What is your investment process?

- How can you find new investment opportunities?

- How can you evaluate cryptocurrency projects?

- Which projects should you invest in?

Investment Implementation helps you successfully implement the strategy.

- How can you implement your investment strategy?

- How can you monitor your portfolio and track the progress?

- How can you manage acquired knowledge?

What can you learn from this book?

Portfolio Management

- Set realistic financial goals

- Evaluate your financial situation

- Choose your investing style

- Determine exposure to crypto and other risk assets

- Compare different asset classes

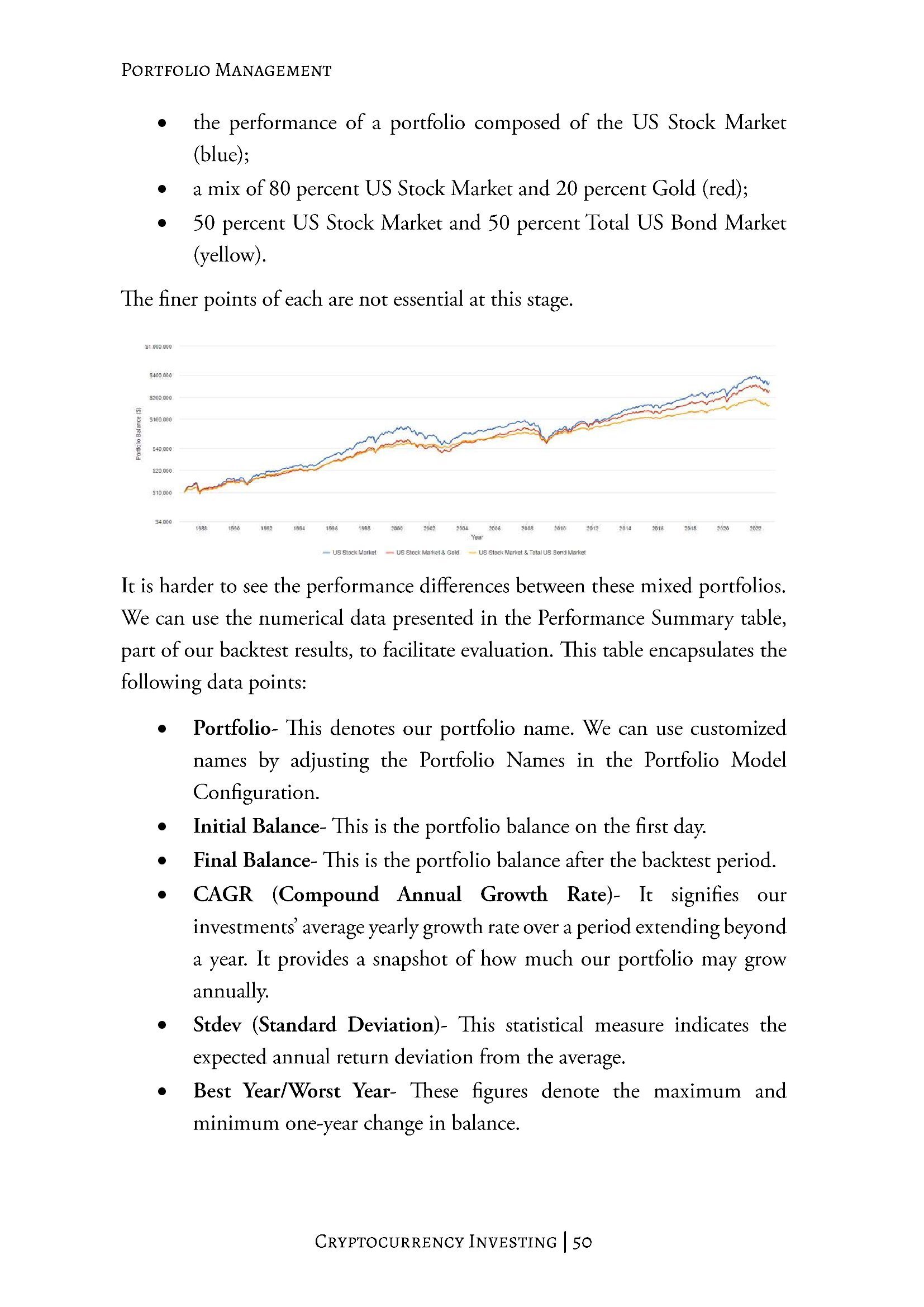

- Create your financial portfolio

- Navigate secular, market, and tactical trends

- Manage investment risks

- Review your progress towards the goal

Investment Strategy

- Create your investment process

- Find new crypto projects

- Create a screening strategy

- Use tokenomics in the investment process

- Check projects’ utility

- Evaluate crypto projects

- Analysis of the most popular projects categories

- Earn more using DeFi

- Create a scoring model

Investment Implementation

- Start investing in cryptocurrencies

- Recognize what affects the success of investing

- Rebalance your portfolio

- Use different investing strategies

- Monitor your portfolio

- Build your knowledge base

- Do research

- Manage paid subscriptions

- Write investment journal

Look inside the book

Join my newsletter

Get your free chapters

Subscribe and receive my weekly newsletter full of email marketing tips.

About the author

For the last ten years, I have worked as a consultant and senior manager in the IT industry. I also had a software company and a fintech start-up.

I invested my financial surplus in the stock market. After learning about cryptocurrencies, I also entered this space. In the absence of a complete guide, I learned from my mistakes.

Two years ago, I started publishing educational content on Twitter as Crypto Engineer. I wanted to professionalize this industry by sharing how to invest in this market.

I won many competitions for the best crypto writer, earning thousands of dollars. This showed me a demand for high-quality content about investing in cryptocurrencies.

“In the first place, we have A Deep Dive Into My Cryptocurrency Investment Process by @cryptoengineer.”

“The first prize goes to Bear Market Mental Models - Are You Ready for the Next Bull Run? by @cryptoengineer.”

“The first prize goes to How to Research New Crypto Projects. Congratulations @cryptoengineer.”

Now, I am writing a book to help you become a successful cryptocurrency investor.

Consulting

I share what it takes to be a successful investor in the book and articles. However, each situation is different, so I cannot give everyone a detailed list of steps.

The purpose of consulting is to work individually on a specific case. Understand the background and financial goals and create a strategy that increases the chance of success.

Write to me if you need help implementing knowledge from this guide. I charge $110 for one hour of online consultancy. You pay after the meeting only if you are satisfied with the results.

I also know this price can be too high for many investors who need additional help. Don't hesitate to write to me about this. I always try to schedule a time for non-paid help.

Q&A

I could not find any guide on how to start investing in crypto that I could offer to my friends and Twitter community. This book is my contribution to the professionalization of the crypto industry.

The book is available on Amazon. You get it here https://www.amazon.com/dp/B0CW1CM6NY. I am also working on wider distribution.

You can get the ebook version now. I am finalizing the paperback and hardcover version.

Just a few dollars for an ebook version. You can also get it for free with Kindle Unlimited.

Yes, just sign up for my newsletter.